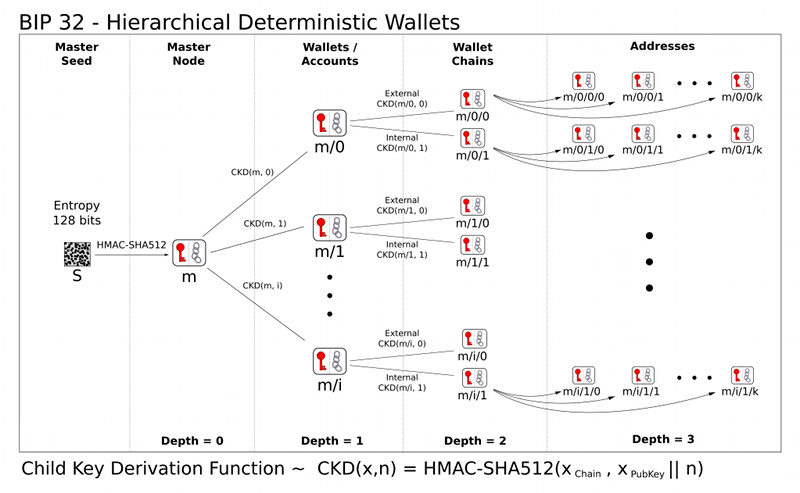

After spending more than 2.5 years financing and overseeing the development of an alternative full-node Bitcoin implementation, btcsuite, it has become clear that Bitcoin has several serious organizational problems. In my previous blog entry, I characterized these problems and their various facets. The main problems are governance, funding development and proof-of-work (PoW) miners having too much power. Over the past 1.5 years I and several developers have been working to propose, code, test and evaluate modifications to Bitcoin that would address these issues. The most fundamental of the changes we have made are based on proposals for hybridized PoW/PoS (proof-of-stake) systems, such as MC2 and proof-of-activity (PoA) by Iddo Bentov, Charles Lee, Alex Mizrahi and Meni Rosenfeld. In order to create a sustainable system of governance, we have created a project Constitution and extended the notion of consensus hybridization to apply more generally as one of several layers in a stratified consensus system. This stratification allows various groups of stakeholders to have representation at various consensus layers. Beyond a layered hybridized consensus system, we have added a consensus rule that allocates 10% of each block reward to a development fund that will be used to pay for ongoing development and related activities. By allocating 10% of each block subsidy to the development fund, continuous development and improvement of the software is possible without the conflicts of interest present in current Bitcoin Core (BC) development process.

Iterating Bitcoin

Hybridized PoW/PoS

The notion of hybridized PoW/PoS is fundamental to what follows, so a bit of an overview is warranted. A consensus system that uses pure PoW is subject to a number of issues: denial-of-service via mining empty or artificially small blocks, censorship by not including certain transactions in blocks and miners having the ability to block or force consensus changes. One way of looking at this situation is to view PoW as providing a single authentication factor to the consensus system, where the PoW is typically performed by one of a small number of entities that do not necessarily represent the rest of the participants in the system. While this process is fundamentally decentralized, practical considerations lead to the PoW mining process becoming very centralized, similar to trusted 3rd party systems, e.g. banks. Hybridizing PoW and PoS creates a second authentication factor for consensus, wherein PoS miners can vote for or against the previous block generated by a PoW miner. If enough PoS miners vote against the previous block, the PoW reward from that block can either be reduced or eliminated entirely, meaning that PoS miners act as a check on the behavior of PoW miners. In the scenarios described above, PoS miners can vote against PoW blocks that they disapprove of, providing a clear incentive for PoW miners to not engage in what most of us would agree is questionable behavior.

Continue reading →